Optimize Your Earnings With Specialist Advice From a Service Audit Consultant

In today's competitive service landscape, the role of a business accountancy consultant is progressively crucial in maximizing profits. These experts not only bring proficiency in monetary monitoring however additionally supply customized methods that can considerably improve your profits. By recognizing your special service needs, they give insights right into budgeting, tax planning, and money flow monitoring, guaranteeing that your economic sources are maximized for development. Yet, the genuine inquiry remains: exactly how can you recognize the appropriate consultant to direct you via the complexities of financial decision-making and unlock your organization's complete possibility?

Understanding the Role of Audit Advisors

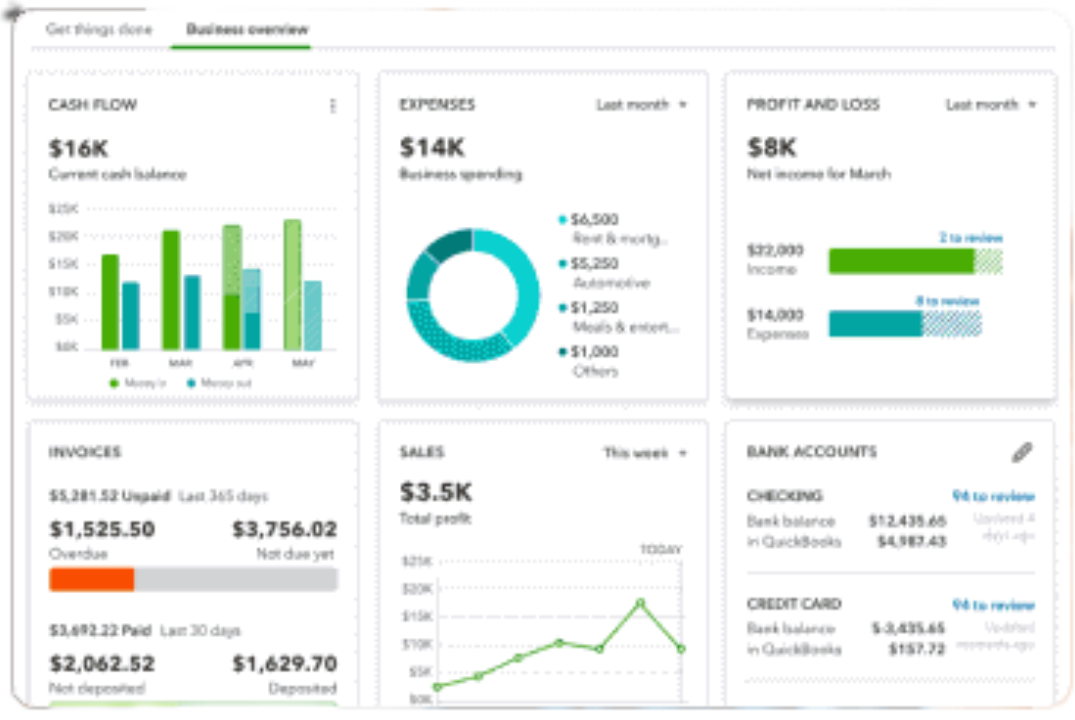

Additionally, audit experts assist in analyzing monetary data, allowing company owner to comprehend their monetary position and prospective locations for development. They additionally play a considerable duty in budgeting and projecting, ensuring that companies allocate sources successfully and plan for future costs (Succentrix Business Advisors). By suggesting on tax obligation strategies and compliance, these specialists aid decrease obligations and enhance monetary outcomes

Furthermore, accounting advisors may aid in recognizing cost-saving chances and improving operational effectiveness, which can lead to improved success. Their proficiency includes giving insights on financial investment decisions and risk monitoring, assisting businesses towards lasting development. Overall, the role of accounting advisors is indispensable to promoting a solid economic structure, encouraging organizations to flourish in a competitive environment.

Advantages of Specialist Financial Guidance

Expert financial support offers countless advantages that can dramatically boost a service's monetary method. Involving with a monetary consultant supplies access to specialist expertise and understandings, enabling businesses to browse complex financial landscapes better. This competence assists in making notified decisions relating to investments, budgeting, and expense administration, therefore enhancing resource appropriation.

Additionally, professional advisors can determine possible dangers and chances that may be forgotten by in-house groups. Their unbiased viewpoint help in developing robust financial projections, enabling businesses to plan for future growth and minimize prospective setbacks. Moreover, monetary advisors can help enhance accounting procedures, making sure compliance with laws and minimizing mistakes that can lead to financial charges.

Secret Services Used by Advisors

Among the essential services offered by monetary consultants, calculated monetary preparation attracts attention as a crucial offering for services looking for to enhance read the article their fiscal health. This includes extensive analysis and forecasting to line up financial resources with lasting organization goals, guaranteeing sustainability and growth.

Additionally, tax obligation planning is an important solution that assists businesses navigate complex tax guidelines and optimize their tax responsibilities. Advisors work to identify potential reductions, debts, and methods that decrease tax burdens while guaranteeing conformity with regulations.

Capital monitoring is one more crucial service, where advisors help in monitoring and enhancing cash money inflows and discharges. Reliable money circulation administration is essential for preserving liquidity and supporting ongoing procedures.

Advisors likewise provide financial coverage and evaluation, providing understandings with comprehensive reports that make it possible for entrepreneur to make informed choices. These reports frequently consist of vital performance indicators and fad analyses.

Last but not least, danger monitoring services anchor are essential for identifying possible economic dangers and establishing strategies to alleviate them. By dealing with these threats proactively, companies can safeguard their properties and guarantee long-term security. Jointly, these services encourage businesses to make enlightened monetary decisions and accomplish their objectives.

Selecting the Right Accounting Consultant

Picking the ideal accounting consultant is a crucial choice that can considerably affect a business's financial success. Review the expert's credentials and credentials.

In addition, evaluate their experience within your market. An advisor acquainted with your details market will certainly comprehend its special difficulties and possibilities, enabling them to offer tailored advice. Search for somebody that demonstrates a positive approach and has a track document of assisting organizations attain their monetary objectives.

Interaction is important in any type of advisory connection. Select an advisor that prioritizes clear and open dialogue, as this fosters an efficient collaboration. Consider the array of services they offer; a well-rounded consultant can offer understandings past fundamental bookkeeping, such as tax obligation method and monetary forecasting.

Lastly, trust your impulses. A solid relationship and shared values are crucial for a long-lasting collaboration. By taking these variables right into account, you can choose a bookkeeping expert who will not only satisfy your requirements but additionally contribute to your company's overall development and profitability.

Real-Life Success Stories

Successful services usually credit their accounting consultants as vital gamers in their financial success. Succentrix Business Advisors. By involving an accountancy advisor, the business executed extensive economic projecting and budgeting methods.

In another case, a startup in the technology sector was coming to grips with fast growth and the intricacies of tax obligation compliance. Business enlisted the expertise of an accounting expert that streamlined their economic procedures and developed a thorough tax obligation technique. Therefore, the startup not just lessened tax liabilities however also protected added funding by offering a robust financial plan to investors, which dramatically increased their development trajectory.

These real-life success stories show just how the ideal accounting consultant can change financial challenges right into chances for growth. By offering tailored methods and insights, these professionals equip companies to maximize their monetary health, allowing them to attain their long-term objectives and take full advantage of earnings.

Verdict

In verdict, the expertise of a service accountancy consultant shows crucial for making the most of profits and achieving lasting development. By supplying tailored techniques in budgeting, tax planning, and money flow management, these professionals equip businesses to navigate economic complexities properly.

Audit advisors play an essential function in the economic health and wellness of a service, giving essential support on numerous financial matters.Additionally, bookkeeping advisors assist in interpreting financial information, permitting company proprietors to understand their economic position and prospective locations for development.Expert monetary support provides many Visit Website advantages that can dramatically improve a company's economic method. Involving with a monetary expert gives accessibility to professional expertise and understandings, enabling organizations to navigate intricate monetary landscapes more efficiently. They can line up financial preparation with certain organization goals, making sure that every economic decision adds to the total strategic vision.